How Many Human-driven Years Remain?

Posted on Nov 1, 2020 in Editorials | 1 comment

Autonomous vehicles and shared mobility are invoked in our contemporary discourse as an inevitable fate. There is an unsettling undercurrent rippling around a not altogether desirable future for the automobile as we know it. I am not anti-progress, anti-technology, or otherwise prone to romanticizing yesteryear. I welcome the convenience and safety of new technologies and look forward to the day I can work during my freeway commute. However, the pleasure and freedom I occasionally indulge — “shifting and drifting” in the words of Canadian rock band Rush — appears increasingly at risk.

How many years are left before we’re no longer able to sit at the left front corner of our cars, row through the gears, and take ourselves on whatever path of discovery we please.

How many self-driven years remain?

In pursuit of answers, I consumed the writing of futurists, think tanks, government agencies, and private industry. I found myriad opinions, some more overtly colored by perspective and politics than others. Ultimately, the most complete, accessible, and logically constructed answer I found was Deloitte Consulting’s “The Future of Mobility.” Nobody has a crystal ball, but this graphic-laden piece lays out a logical framework for understanding the future of mobility anyone can understand. For those with the time and interest, I recommend reading it.

Four Stages

The scale of the $2 trillion extended automotive industry in the United States, combined with the scope of probable change, make predicting the path of transformation and its impacts challenging.

There are at least three considerations related to the incumbent automakers — and, thus, to people interested in driving themselves — deserving of additional attention: the change in demand for new vehicles; the transformation of light vehicle sales channels; and the implications for future vehicle architecture, layout, and pricing.

Perspectives on how the future will unfold depend largely on one’s viewpoint. Predictably, the disruptors such as Google, Apple, and Faraday Future envision rapid radical change, and the incumbent automakers envision slower, more incremental steps. The delta between these viewpoints is less about if a transformation will occur, and more about its speed and disruptive impact. Deloitte, which is equally happy working with incumbent automakers or disruptors, predicts that a systematic shift will emerge “unevenly across geographic, demographic, and other dimensions, and evolve in phases over time.”

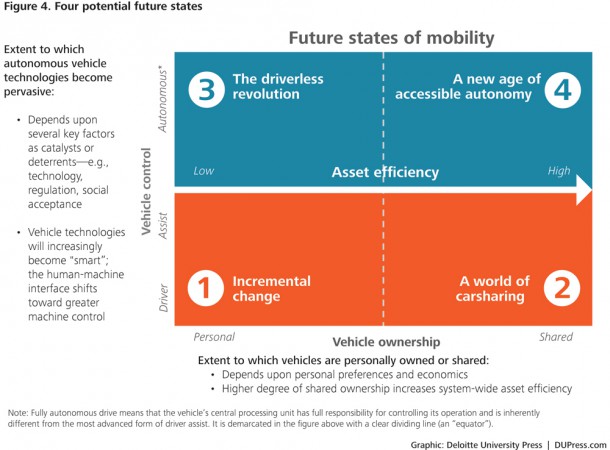

It sounds like they are sitting on the fence — and they are — but that is a reflection of the likely reality. Deloitte has created a simple box divided into four quadrants depicting a likely progression across four future states of mobility. Two fundamental trends will drive the progression from quadrant one to quadrant four: vehicle control (driver vs autonomous) and vehicle ownership (private vs shared).

The market is presently in the first stage, characterized by continued individual vehicle ownership, the ongoing development of driver-assist technologies, and preliminary deployments of V2X (Vehicle-to-Vehicle and Vehicle-to-Infrastructure sensors and communications).

The second future state of mobility begins as economic momentum drives down the cost-per-mile of shared mobility and the decline of the multi-vehicle household begins.

The third future state is prompted when autonomous technology and infrastructure achieves a tipping point of safety, convenience, and cost effectiveness; autonomous vehicles become the norm, rather than the exception, and road safety is dramatically improved.

The fourth future state is the disruptors’ nirvana. This is where autonomy and vehicle sharing converge. From the near elimination of parking lots, to the reimagining of auto interiors, change will reverberate across our landscape and culture.

Implications for Automakers and Drivers

One of the most striking transitions may be the exaggerated perception that there will be a reduction in demand for automobiles. As more individuals opt to share mobility, the demand for new vehicles should decrease. The average individually owned car today has a utilization rate of 4 percent, a striking contrast versus 40 percent for common livery vehicles. As individual ownership rates erode and vehicle utilization rates climb, vehicle lifecycles will compress.

The 24,000 New York City taxis and black cars offer a glimpse into future vehicle lifespans. The average New York cab is 3.3 years old and the average black car is 5.5 years old. The average light vehicle registered in the U.S. today: 11.4 years old. As utilization rates increase and average vehicle age declines, what replacement rate will be required to meet demand?

Based on the last 14 years of data, with the 2008 to 2011 recession years removed, the average annual sales required to replace the light vehicle fleet in the U.S. is 15.1 million. Maintaining the same replacement rate and modeling a steady decline in automobiles per 1,000 Americans, from 790 today to 540 in 2025, the aggregate demand for new automobiles will trend toward 14 million in 2025. This does not represent a paradigm shift in demand. It represents a 19 percent decline from 2015’s record sales and just a seven percent decrease from the 14 year average.

Demand may not decline radically, but what are the implications for automakers’ sales channels? Individuals will continue to purchase cars for many years and groups of individuals may syndicate purchases, much as they do today to buy boats and aircraft. However, mobility providers, as presently exemplified by Uber and Lyft, will replace individual shoppers as the dominant vehicle acquirers.

This shift away from selling to individuals and toward mobility aggregators will have a profound impact on automakers and their dealer networks. Automakers that presently serve commercial customers effectively may be best positioned to successfully navigate this transition. Those that are not are advised to consider their future allocation of resources. For example, will it be efficient for Ford to maintain 3,000 dealers in the U.S., much less 11,000 globally?

Automakers have begun preparing. Mercedes got a head start when it founded car2go in 2008, which now boasts one million members. More recently, Ford partnered with car-sharing provider Getaround and is piloting a shared leasing program. And GM announced a $500 million investment in car-sharing provider Lyft, in addition to founding Maven, its own car-sharing service. Questions abound regarding the wisdom of automakers vertically integrating into end-to-end mobility providers, versus continuing to sell and finance automobiles. Nonetheless, these activities represent acknowledgement of the looming transformation, though they fall well short of preparing their distribution channels for what’s ahead.

Truly radical automotive change will not occur until the fourth stage of future mobility. In this phase, the prerequisites for entirely new vehicle architectures and form-factors will arrive. Those prerequisites include not only fully autonomous vehicles, but the utter dominance of such vehicles. Autonomous vehicles will need to far outnumber human operated vehicles, perhaps ten to one, before federal regulators will adjust crash safety standards. At some point, the operation of legacy vehicles may be restricted to specific places and/or times. But until human operated cars are effectively gone or heavily restricted, safety standards will keep us in vehicles that look, weigh, and cost largely as they do today.

The transition to lighter construction and presently unknown form-factors will be radical. This revolution may be the ultimate disrupter for the incumbents. As safety regulations become easier to comply with, barriers to entry may be torn down. Auto manufacturers already outsourcing key portions of battery development and manufacturing may return to their roots as coach builders. Fast forward 20 years and the industry may bifurcate into battery companies and coach builders. Automakers that have not by this time monetized the data generated in and around their vehicles may be left with very little value to add. Even if the automotive market maintains demand for 14 million units, the retail price for mobility hardware may reach as low as $10,000 per car.

An analogy exists with the advent of recorded music. Humans created music for thousands of years, but it was not until Thomas Edison invented the phonograph in 1877 that recording music became possible. Artists and instrument makers were not enthusiastic adopters of the new technology. In fact, the right to record and sell music was litigated well into the 1920s with radio operators pitted against recording companies.

So too today some find the thought of surrendering all driving responsibility unpleasant. The most extreme prognostications, while likely accurate in form if not time, are more than two decades in the future. If you are reading this today, there is a strong chance you won’t live to see your conventionally operated vehicle proscribed from a weekend romp.

Speaking for myself, if I had access to a self-driving vehicle today, I would buy it. (Or, if I could have a nice vehicle reliably show up at my door within 10 minutes of requesting it, I’d take that option too.)

I have a couple hundred square feet of my house dedicated to vehicle storage, (a.k.a two-car garage), hundreds of dollars in tools and supplies to maintain them (in lieu of even more money spent elsewhere), insurance, hassle, etc., that would all go away and I wouldn’t miss any of it.

When I drive, I want an engaging and quality experience, but given the option of avoiding driving altogether? I’ll take that if it’s available for a reasonable price; there are things I would rather do with my time than drive.

I don’t think my feelings are at all unique.