Steven Lang And Doug DeMuro Debate Carmax

Posted on Mar 6, 2015 in Editorials | 1 comment

Earlier this week I wrote about how CarMax is heavily constrained by a market that has flip-flopped between six years worth of heavy car sales and about 18 months of resurgent truck and SUV demand. Long story short, CarMax’s acquisition costs for trucks, SUVs and crossovers has gone up considerably, and the supply of this inventory has cratered due to new car dealers keeping the bulk of this inventory for themselves.

Not everybody liked what I wrote. Case in point.

Within a couple hours of my posting the article on Facebook, I received a response from a good friend who has been linked to CarMax time and time again: Doug DeMuro.

Doug has been a champion of CarMax and their extended warranties in much the same way as I would champion staying the hell away from any extended warranty plan.

Doug loves his Range Rover that he bought from CarMax. I think it’s overpriced junk. He features Hummers and Ferraris. I finance Fords and Suzukis. Doug and I have historically been at polar-opposite ends when it comes to a variety of retail-related topics (extended warranty plans, what used cars to buy, the fact belief that luxury minivans are a dumb idea), and it didn’t long for the two of us to ram heads when it came to CarMax and their recent financials.

Doug DeMuro: There’s no news! CarMax reported $128M in earnings this quarter, down from last year’s $130M. That’s miniscule. And earnings per share was actually up, from 60c to 63c. All companies have bad quarters, and this wasn’t even that. I have absolutely no doubt CarMax will continue along full speed ahead.

Steven Lang: Care to debate me on that Doug?

Doug DeMuro: Right after we debate Amazon being in “big trouble” because they missed earnings in Q3 2014:

http://www.cnbc.com/…/amazon-earnings-95-cents-lost-per…

Since then the stock is up 115 percent and they just passed Wal-Mart as America’s largest retailer by market cap. Time will tell …

Steven Lang: We are on the same wavelength when it comes to Amazon. I even wrote about it on Jalopnik. Carmax is a different story based on market fundamentals. Care to have a friendly public debate?

Doug DeMuro: Unfortunately, neither of us are impartial. You are a competitor of CarMax’s, and have a financial interest in their failure.

Meanwhile, as for me, when I went to drive my Range Rover the other day, it was tilted to one side like the Titanic right before Leonardo DiCaprio froze to death. Also, the power folding mirrors no longer operate. So I have a financial interest in CarMax’s continued success and prosperity, at least until my warranty runs out on December 7, 2018, a date which will live in extended service contract infamy.

Here’s what I propose: instead of a debate, we get a dog and we line him up at a row of car dealerships, next to a CarMax and a name-brand dealer. Then we have the employees stand outside and scream and yell and hold up treats to try to attract the dog. Whoever the dog chooses wins.

NOTE: I also think this is how the World Cup should be decided, and the majority of Division III college football games.

Or we can just check the numbers in a year smile emoticon

EDIT: This may be obvious but I just wanted to note that the dog must be an IMPARTIAL breed, such as a labradoodle or a chihuahua, and not one of those biased great danes, which I am told heavily prefer a) name brand car dealerships and also b) slobbering all over your clothes.

Steven Lang: Funny, but untrue. I don’t sell late-model cars and actually have purchased hundreds of their trade-ins. I want them to succeed but that’s beside the point. I’m offering a third and final opportunity to debate the merits. It’s your call.

Doug DeMuro OK, OK, you don’t like the dog idea. A better plan: you walk into a CarMax. I walk into a name brand car dealer. We both examine their free giveaways to see which is better. Does CarMax free coffee trump Name Brand Dealership bag of Frito’s? Does CarMax free windbreaker trump Name Brand Dealership free glossy brochure of the 2013 RAM 1500, of which they still have nine in inventory??? WE FIND OUT!

IF YOU WANT ME TO BE SERIOUS, which I find very difficult to do, I will say this: it is never, ever, EVER, a good idea to judge a company based on one, or even four, bad quarters. I mean, hell, Volvo has been having bad quarters since like 2004, and they’re still kickin! And I was just in a new XC90, where the infotainment screen is so big it could swallow a child, sort of like in “The Ring” except the child wouldn’t try to kill you, it would merely provide directions in Swedish.

Here’s the reality: CarMax stock was trading around $18 per share in summer 2012, and by summer 2015 it was well above $70 per share. This is a 170 percent increase in three years, and it is unsustainable for ANY company. ANY company in ANY part of the world, selling ANY product. They are bound to slow down. So now they are slowing down, and I think it’s wrong to use one SLIGHTLY off-the-mark quarter say they’re in “serious trouble.” To be honest, I don’t find it a point worth debating. And I would make the same argument for CarMax, or Amazon, or Netflix, or Apple, or the company that makes the chair I’m sitting on. (“Cheap Shit From China Inc.)

So like I said, we will see the numbers in a year. If CarMax is still faltering, then we can debate it! With or without dogs.

Steven Lang: You’re parsing out the facts. CarMax is at the same price point as they were eight years ago and their issues go far beyond having one bad quarter. You insinuating that I base my findings on one bad quarter is almost as deceptive as you promoting extended warranties based on one bad car. If you can offer anything other than canned cliches and Dave Barry impersonations, feel free. Otherwise I’ll see this thread as yet another lightweight song and dance.

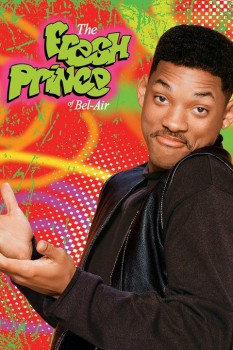

Doug DeMuro: Canned cliches? WHICH ONE OF MY CLICHES ARE CANNED? They’re FRESH, dammit, like Whole Foods. LIKE SHEETS OUT OF THE DRYER. LIKE THE PRINCE OF BEL AIR!!!!!

And so our little mini-debate kinda came and went. Doug does have a decent point about one quarter not making a bad company (although he underestimates my familiarity with confused labradoodles since I own one) and I’m right on the money on pretty much everything else.

“It’s a mistake to confuse stock performance with business performance.”

People who actually make investment decisions need to have this tattooed on the insides of their eyelids.

It is *especially* true for retail businesses that have huge fixed costs and operate in volatile markets. CarMax certainly fits this description.